Bitcoin Price Prediction – July 18, 2025: Can BTC Hit $142K as Crypto Market Cap Surges to $4 Trillion?

With the global crypto market cap surpassing $4 trillion, can Bitcoin rally to $142K? Explore BTC’s July 2025 outlook, trends, and price analysis.

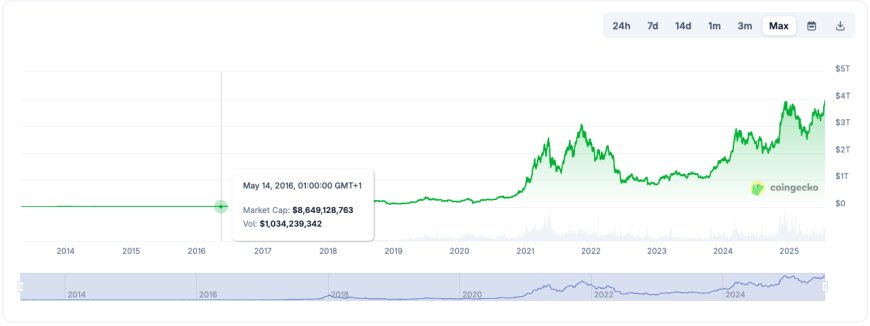

The global cryptocurrency market capitalization has officially crossed the $4 trillion threshold for the first time, fueled by a massive influx of capital—particularly into Bitcoin, which now commands over 59% of the total market valuation.

Since January 2024, the market has seen over $2 trillion in fresh capital, with Bitcoin alone attracting over $1.2 trillion in new investments. While Bitcoin’s recent momentum has cooled over the last 48 hours, opening space for altcoins like Ethereum and Solana to gain, analysts maintain a bullish stance with BTC’s trajectory pointing toward a $142,000 target.

CryptoQuant Reveals a 20-25% Upside that Could Fuel $140K BTC

At present, Bitcoin is trading at $118,856 after facing resistance around the $123,000 level, where bearish buy-side liquidity led to rejection and formed a mid-range bearish structure.

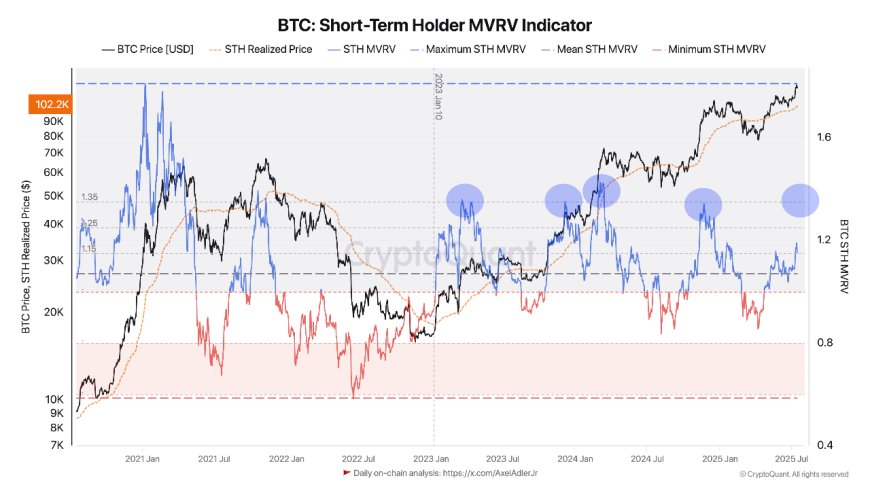

CryptoQuant’s latest analysis highlights that the Short-Term Holder (STH) MVRV indicator suggests more upside potential is likely.

Historically, when the STH MVRV approaches 1.35 (about 35% in unrealized gains), the market tends to see profit-taking and short-term corrections. Currently, with the STH MVRV at 1.15, there’s still room for BTC to climb another 20–25% before reaching this critical level.

Adding fuel to the rally, reports suggest former U.S. President Donald Trump is preparing to allow access to Bitcoin and crypto investments via the $9 trillion U.S. retirement market, according to the Financial Times.

This makes a 20% breakout to the $140,000 zone increasingly plausible.

Technical Analysis: Will $121K Resistance Break or Hold?

The BTC/USDT daily chart shows a consolidation phase just under the significant $121K resistance level.

Bitcoin remains above the 9-day SMA, reflecting ongoing bullish momentum. A breakout above this range could trigger a swift push toward the next target at $132,286.

With the RSI currently at 70.08, BTC is nearing overbought territory—but not yet in danger. Bulls still hold the upper hand.

Support is well-established near $111K, reinforced by both technical structure and alignment with the STH MVRV value zone of $102,764—often a key level for short-term holders.

Overall, the chart setup leans bullish. A breakout above $121K could set the stage for a continued rally, while failure to clear resistance might lead to a retest between $111K and $115K.

Bitcoin Hyper Raises $3.31M: Layer-2 Project Gains Momentum

As Bitcoin trends upward, early-stage investors are actively shifting focus to Layer-2 projects building on Bitcoin’s base chain.

One standout project, Bitcoin Hyper (HYPER), has now secured over $3.31 million in presale funding—with $600,000 raised just in the last four days.

Bitcoin Hyper’s Layer-2 infrastructure aims to boost Bitcoin’s transaction speed, scalability, and utility. The presale follows a timed price-increase format—$HYPER is currently priced at $0.01225, with the next price hike scheduled within six hours.

For those looking to get in early, the official presale website contains complete information about the project, infrastructure, and token acquisition before the next price surge.